This is a summary of our JPER journal article (available here) about Craigslist rental listings’ insights into U.S. housing markets.

Rentals make up a significant portion of the U.S. housing market, but much of this market activity is poorly understood due to its informal characteristics and historically minimal data trail. The UC Berkeley Urban Analytics Lab collected, validated, and analyzed 11 million Craigslist rental listings to discover fine-grained patterns across metropolitan housing markets in the United States. I’ll summarize our findings below and explain the methodology at the bottom.

Rentals make up a significant portion of the U.S. housing market, but much of this market activity is poorly understood due to its informal characteristics and historically minimal data trail. The UC Berkeley Urban Analytics Lab collected, validated, and analyzed 11 million Craigslist rental listings to discover fine-grained patterns across metropolitan housing markets in the United States. I’ll summarize our findings below and explain the methodology at the bottom.

But first, 4 key takeaways:

- There are incredibly few rental units below fair market rent in the hottest housing markets. Some metro areas like New York and Boston have only single-digit percentages of Craigslist rental listings below fair market rent. That’s really low.

- This problem doesn’t exclusively affect the poor: the share of its income that the typical household would spend on the typical rent in cities like New York and San Francisco exceeds the threshold for “rent burden.”

- Rents are more “compressed” in soft markets. For example, in Detroit, most of the listed units are concentrated within a very narrow band of rent/ft² values, but in San Francisco rents are much more dispersed. Housing vouchers may end up working very differently in high-cost vs low-cost areas.

- Craigslist listings correspond reasonably well with Dept of Housing and Urban Development (HUD) estimates, but provide up-to-date data including unit characteristics, from neighborhood to national scales. For example, we can see how rents are changing, neighborhood by neighborhood, in San Francisco in a given month.

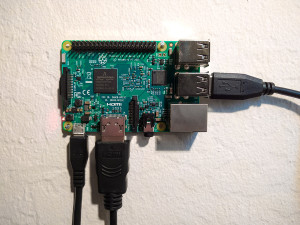

A guide to setting up the Python scientific stack, well-suited for geospatial analysis, on a Raspberry Pi 3. The whole process takes just a few minutes.

A guide to setting up the Python scientific stack, well-suited for geospatial analysis, on a Raspberry Pi 3. The whole process takes just a few minutes.