New Article: Craigslist Housing Markets in JPER

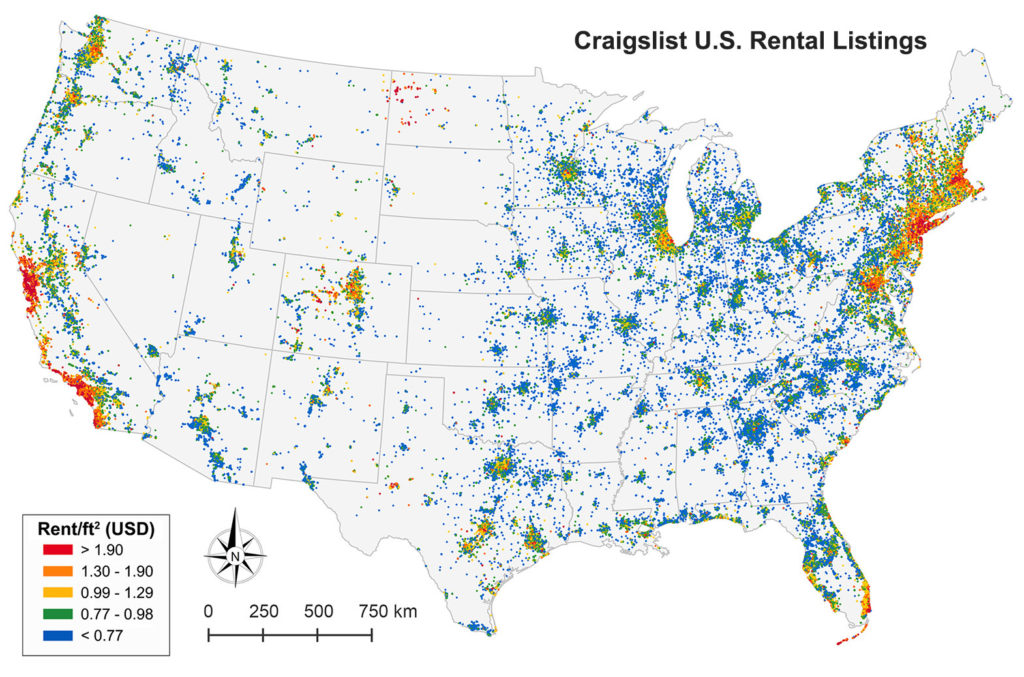

Our article “New Insights into Rental Housing Markets across the United States: Web Scraping and Analyzing Craigslist Rental Listings” is finally appearing in print in the Journal of Planning Education and Research ‘s forthcoming winter issue. We collected, validated, and analyzed 11 million Craigslist rental listings to discover fine-grained patterns across metropolitan housing markets in the United States.

Here are 4 key takeaways:

- There are incredibly few rental units below fair market rent in the hottest housing markets. Some metro areas like New York and Boston have only single-digit percentages of Craigslist rental listings below fair market rent. That’s really low.

- This problem doesn’t exclusively affect the poor: the share of its income that the typical household would spend on the typical rent in cities like New York and San Francisco exceeds the threshold for “rent burden.”

- Rents are more “compressed” in soft markets. For example, in Detroit, most of the listed units are concentrated within a very narrow band of rent/ft² values, but in San Francisco rents are much more dispersed. Housing vouchers may end up working very differently in high-cost vs low-cost areas.

- Craigslist listings correspond reasonably well with Dept of Housing and Urban Development (HUD) estimates, but provide up-to-date data including unit characteristics, from neighborhood to national scales. For example, we can see how rents are changing, neighborhood by neighborhood, in San Francisco in a given month.

From the journal article’s abstract:

Current sources of data on rental housing—such as the census or commercial databases that focus on large apartment complexes—do not reflect recent market activity or the full scope of the US rental market. To address this gap, we collected, cleaned, analyzed, mapped, and visualized eleven million Craigslist rental housing listings. The data reveal fine-grained spatial and temporal patterns within and across metropolitan housing markets in the United States. We find that some metropolitan areas have only single-digit percentages of listings below fair market rent. Nontraditional sources of volunteered geographic information offer planners real-time, local-scale estimates of rent and housing characteristics currently lacking in alternative sources, such as census data.

For more info on this project and the findings from analyzing Craigslist housing markets, check out this summary blog post or download the JPER journal article. Also see this analysis of census rents data.